-

24

24

Mar POINT OF TAXATION RULES- (Category: Service Tax)

INTRODUCTION:

In the case of introduction of every act, rules, circulars or notifications there must be an underlying purpose. This purpose is the basic object of introduction of the act, rules, circulars or notifications or any amendments to the statues.. If we are able to appreciate the object of the introduction or amendments, we shall be understand the newly introduced statute or their amendments in a better manner.

The Point of taxations rules is also not an exemption to this general principle. This takes to the question, what is the object of the Point of Taxation Rules, 2011?Service tax was introduced by Finance Act, 1994 with effect from 1-7-1994. At that time only three services were taxed. To make the people to accept the new levy the rate of tax was fixed at 5% only. Similarly the service providers are the agents for the government. They collect the tax from their customers and pay it to the government. This is a “free service” rendered by the service providers (subsequently by service receivers also) to the government. To get the acceptance of these “agents”, the government made a concession that the service tax shall be paid to the government, only when the amount is realised by them from their customers. But from 1-4-2011, this system of payment service tax was changed. From that date it was made a mandatory to make payment, whether the service provider has received the payment or not. In simple accounting terms, the cash system of payment was changed to accrual system.

PECULIAR NATURE OF SERVICE TAX:

There are three main indirect taxes. They are

1.Central Excise

2.Value Added Tax or Sales Tax

3.Service Tax.The one striking difference between the first two acts and service tax is the treatment of advance received. In case of the Central Excise and Sales tax, the liability to pay the tax does not arise, when the advance amount is received. But in case of service tax only the assessee is made to pay the service tax, even when the advance is received from the party. To settle the issues arising out of the determination of tax liability due to the taxation of advance receipts and other matters only, the point of taxation rules have been formed.

To illustrate this point the following hypothetical questions are formed.

1. The rate of service tax been increased from 10% to 12% with effect from 1-3-2012. Suppose Mr. A, who is a service provider has received an advance of Rs.1,00,000/- on 1-1-2012. But he renders service after 1-3-2012, i.e., after the increase of the rate of service tax. So now the question arises, what is the rate to be charged?

2. Mr. B has rendered service on 25-2-2012, i.e., prior to the increase in the rate of tax. But he raises the invoice on 5-3-2012. i.e., after the increase of the rate of service tax. So now the question arises, what is the rate to be charged?

To give solutions to situations mentioned above and other related issues only the Point of Taxation Rules, 2011 has been framed by the government.

ORIGIN OF POINT OF TAXATION RULES:

In the Finance Act, 1994, the entire service payment mechanism has been left to the discretion of the rule making authorities. Section 68(1) of the Finance Act, 1994, “Every person providing taxable service to any person shall pay service tax at the rate specified in section 66B in such manner and within such period as may be prescribed.”

Only the rate of service tax has to be as per section 66B. But the payment and periodicity of the payment should be in the manner as prescribed in the rules.

Rule 6 of the Service Tax Rules, 1994 deals with the payment of service tax.

Prior to amendment, the Rule 6(1) stood as under.

The service tax shall be paid to the credit of the Central Government ………….. immediately following the calendar month in which the payments are received, towards the value of taxable services.

But this rule has been amended with effect from 1-4-2011 as follows.

The service tax shall be paid to the credit of the Central Government ………….. immediately following the calendar month in which the service is deemed to be provided as per the rules framed in this regard.

So the payment obligation arises when the service is deemed to be provided. For this purpose only the Point of Taxation Rules, 2011 has been formed.

According to Rule 2(e) of the Point of Taxation rules, “point of taxation” means the point in time when a service shall be deemed to have been provided.Payment to the Government = Service is deemed to be provided

Service is deemed to be provided = point of taxation

As a corollary to the above equation

Payment to the Government = Point of TaxationPOT Rules help us to determine the when POT arises in the following situations.

1.General

2.POT in case of continuous supply of service.

3.POT in case of change in effective rate of tax.

4.POT in case of new services.

5.POT in case of certain specified services or persons

6.POT in case of Copyrights.POINT OF TAXATION IN A GENERAL SITUATION:

Rule 3 of the Point of Taxation rules, 2011 deals with the point of taxation in all general situations. According to this rule the point of taxation shall be, “the time when the invoice for the service provided or to be provided is issued.”

So as soon as invoice is issued liability to pay the service tax arises. Here we have to see the wording, “to be provided is issued”. So if you issue an invoice prior to the provision of service, the liability arises. But the invoice cannot be equated with proforma invoice or quotation.

Another important condition is that the invoice should be issued within the time period specified in rule 4A of the Service Tax Rules, 1994. According to rule 4A, the invoice for the services provided should be issued within 30 days from the date of completion of the service. If the invoice is not issued within this period then the date of completion is the point of taxation, and not the date of invoice. This will alter the due date for payment of service tax. In reckoning this period the date of the completion of service too should be included.

When the service provider received payment before completion of service or before the issue of invoice, the time of receipt of payment shall be the POT.

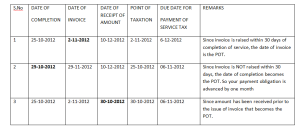

EXAMPLE: XYZ Ltd gives the following details. It is assumed that the service tax is deposited electronically through internet banking, so the due date for payment is 6th day of the immediately following month

CBEC CIRCULAR REGARDING COMPLETION OF SERVICE: CIRCULAR NUMBER 144/13/2011-S.T., dated 18-7-2011

In some cases, the ascertainment of date of completion of service is very difficult. This is more so in the case of construction contracts. The receiver of service has to check the various provisions and take measurement of the building. For this he will appoint qualified engineers. So the difficulty in determining the time of completion of services was pointed to the department. So due to this representation a circular was issued by CBEC.

According to this circular,

Completion of service “would include not only the physical part of providing the service but also the completion of all other auxiliary activities”

“Such auxiliary activities could include activities like measurement, quality testing etc. which may be essential pre-requisites for identification of completion of service”

“The test for the determination whether a service has been completed would be the completion of all the related activities”

WARNING IN THE CIRCULAR:

However such activities do not include flimsy or irrelevant grounds for delay in issuance of invoice.

POINT OF TAXATION IN CASE OF CONTINUOUS SUPPLY OF SERVICE:

Earlier rule 6 of the Point of Taxation rules, 2011 dealt with the POT in case of continuous supply of service. But now this rule has been omitted with effect from 1-4-2012 and this has been merged with the rule 3 itself.

What is continuous supply of service?

There is a definition for Continuous supply of service in the POT rules. Clause (c) of Rule 2 of point of taxation rules, 2011 defines, “continuous supply of service” means any service which is provided, or agreed to be provided continuously or on recurrent basis, under a contract, for a period exceeding three months with the obligation for payment periodically or from time to time, or where the Central Government, by a notification in the Official Gazette, prescribes provision of a particular service to be a continuous supply of service, whether or not subject to any condition.

TWO situations are considered as a CONTINUOUS SUPPLY OF SERVICE

Any service which is provided, or agreed to be provided continuously or on recurrent basis, under a contract, for a period exceeding three months.

Where the Central Government, by a notification in the Official Gazette, prescribes provision of a particular service to be a continuous supply of service.

Any service for a period of more than three months is considered as a continuous supply of service. The contract may be oral. Prior to 1-4-2012 the words were, “or to be provided continuously, under a contract, for a period exceeding three months”.

With effect from 1-4-2012 these words have been substituted as, ” or agreed to be provided continuously or on recurrent basis, under a contract, for a period exceeding three months with the obligation for payment periodically or from time to time…”

The purpose of this amendment is explained in the TRU D. O. F. No 334/1/2012-TRU New Delhi, dated 16th March, 2012

The definition of continuous supply of service is being amended to capture the concept in a more wholesome manner, namely the recurrent nature of services and the obligation for payment periodically or from time-to-time.

Earlier the period of contract can be split up into a period less than three months. Moreover the wordings are of the nature that if the work is to be done in once in three months, for one year, this will be considered as a service provided “not continuously for a period exceeding three months”. Now all these contracts will be covered by the words, “on recurrent basis”

The government has the power to notify some services as CONTINUOUS SUPPLY OF SERVICE. In such a case, when a notification is issued, that service even if it for a period less than three months it is considered as continuous supply of service.

The government has notified (Notification No.38/2012 dated 20-6-2012) the following services as CONTINUOUS SUPPLY OF SERVICE

(a) Telecommunication service

(b) service portion in execution of a works contractIn case of continuous supply of services the date of completion of each event will be deemed to be the date of completion of provision of service.

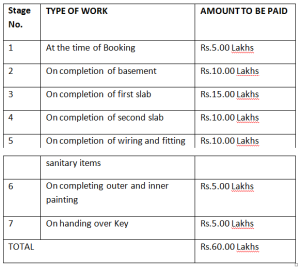

Understanding this example will help us to grasp the continuous supply of services in a better manner.

Vijay Constructions P. Ltd is engaged in the Construction of flats. It enters into an agreement with Ramesh to sell one of the Flat in a new venture for a total consideration of Rs.60.00 Lakhs. The payment has to be made in the following schedule

The completion of every stage is considered as a point of taxation. The service tax liability for Vijay Constructions P. Ltd will start on completion of every stage, whether it has received the payment from Mr. Ramesh or not.

POINT OF TAXATION IN CASE OF CHANGE IN EFFECTIVE RATE OF TAX:

Rule 4 of the POT deals with the situation, when there is a change in the rate of taxation, as we saw during the current financial year. The rate of service tax was restored to the original rate of 12% from 10% with effect from 1-4-2012. Prior to 1-4-2012, there was an explanation to Rule 4. Which defined “change in effective rate of tax”. Now this explanation has been omitted. But this has been brought into the definition portion of the POT Rules, 2011. This new definition is the almost the reproduction of the words as contained in the explanation. The new definition as contained in rule 2 runs as under.

(ba) “change in effective rate of tax” shall include a change in the portion of value on which tax is payable in terms of a notification issued in the Official Gazette under the provisions of the Act, or rules made thereunder.

The object of this definition is to cover the cases of abatement also. For example in case hotels the taxable portion of service was enhanced from 50% to 60%. So there is a change in the portion of value on which tax is payable.

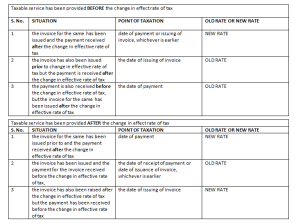

Earlier, before the introduction of Point of Taxation Rules, 2011, if we render service prior to change in rate only the old rate of tax will apply. Now this is not the case. TWO broad situations are envisaged.

1.Taxable service has been provided before the change in effect rate of tax

2.Taxable service has been provided after the change in effect rate of tax

POINT OF SERVICE IN CASE OF NEW SERVICES:

Prior to the introduction of negative list based system of service taxation, every finance act introduces a new service in the list of taxable service. So the question arises what is the point of taxation when a new service is introduced. Even after the introduction of the negative list based taxation, this rule is relevant, suppose an item of service is removed from the negative list or in the mega exemption notification an item is omitted, then the question of ascertaining the point of taxation arises.

Rule 5 of POT rules provide answer for this question.

When both invoice has been issued and payment has been received before such service becomes taxable, no service tax should be paid. Here even if the service is rendered after the service becomes taxable, there will not be any service tax liability.

Similarly if the payment is received prior to such service becomes taxable and the invoice is issued within 14 days of the date when the service is taxed for the first time, there will not be any service tax liability.

For example the new service comes into effect from 1-7-2012. You have received payment on 20-6-2012 and you have raised invoice on 5-7-2012, you will not be liable for service tax, even if the service is rendered after that date.

CERTAIN SERVICES FOR WHICH STILL THE RECEIPT OF PAYMENT IS THE POINT OF TAXATION:

Earlier some EIGHT services were made liable to pay service tax only on receipt basis. Now this benefit has been extended to all services. But this is not done under the point of taxation rules. But this was made by amending service tax rules. As a consequence these services list was omitted from Rule 7 of POT Rules.

The newly introduced third proviso to Sub-Rule (1) of Rule 6 of the Service Tax Rules, 1994 reads as under.

“Provided also that in case of individuals and partnership firms whose aggregate value of taxable services provided from one or more premises is fifty lakh rupees or less in the previous financial year, the service provider shall have the option to pay tax on taxable services provided or agreed to be provided by him up to a total of rupees fifty lakhs in the current financial year, by the dates specified in this sub-rule with respect to the month or quarter, as the case may be, in which payment is received.”

In view of the above provision, if an assessee is an individual or partnership firm then they can continue to pay the service tax on receipt basis.

Moreover when the service tax is paid under reverse charge mechanism, where the recipients of service are made liable to pay the service tax, the date of payment is the point of taxation. But if the payment is not made within six months of the date of invoice, then the POT is the date of invoice.

In case of associated enterprise is located outside India, the POT is the earlier of the following two events.

(a)Date of debit in the books of the person receiving the service or

(b)Date of making payment.POINT OF TAXATION IN CASE OF COPY RIGHTS:

In case of copy rights the payment will come after a long time. So the service shall be treated as having been provided each time when a payment in respect of such use or the benefit is received by the provider in respect thereof, or an invoice is issued by the provider, whichever is earlier.

POWER TO THE CENTRAL EXCISE OFFICER TO DETERMINE THE POINT OF TAXATION:

A new rule 8A has been introduced to the POT Rules, with effect from 1-4-2012. This gives the power to the central excise officer to determine the point of taxation. This power can be exercised, only where the point of taxation cannot be determined as per these rules. When fixing the point of taxation by exercising this power the Central Excise Officer should give an opportunity of hearing to the concerned person.

DATE OF PAYMENT:

This is a new rule to collect the tax at the earliest point, even when in the case of receipt of the amount.We have already seen that the if the amount is received prior to the issue of invoice, then the date of payment is the point of taxation. To collect the service tax at the earliest point, the date of payment has been defined as a separate rule. The new rule 2A deals with the date of payment. According to this rule the earlier of the following dates is considered as the date of payment.

Date on which the payment is entered in the books of accounts

OR

Date on which payment is credited to the bank account.ILLUSTRATION:

XYZ Pvt Limited is engaged in creating an advertising content for Chennai Silks. For this XYZ Pvt Limited has sought an advance of Rs.25 Lakhs from Chennai silks. Chennai Silks sends this amount by RTGS to the bank account of XYZ Pvt Limited on 31-10-2012. This amount is credited on the same date to the bank account of XYZ Pvt Limited. But XYZ Pvt makes receipt on 1-11-2012 after verifying the bank accounts. Here the point of taxation is 31-10-2012. So service tax has to be paid on or before 6th November 2012.

About thr author : admin