-

10

10

Jul “GST Applicability on Clubs & Associations”- GST, GST UPDATES / By Aravind Paul / No Comments / 257 Viewers

Reference: Order of the Maharashtra Appellate Authority for Advance Ruling in the case of Rotary Club of Mumbai Queens Necklace. In this case the Authority for Advance ruling has originally held that The amount collected as membership, subscription and admission fees from members is liable to GST as supply of services, Against this order Rotary

Continue Reading 01

01

Jul GST UPDATES JULY 2020- GST UPDATES / By Aravind Paul / No Comments / 152 Viewers

26

26

Jun TAX UPDATES JULY 2020- GST UPDATES, IT / By Aravind Paul / No Comments / 276 Viewers

From the desk of our Chairman Paul Thangam” The impact of the global pandemic COVID 19 on every business is immense. Every business has been compelled to re-think on their fundamental assumptions and presumptions about their day-to-day business operations. The overall business sentiment in the economy is very low. However, at this juncture, we wish

Continue Reading 10

10

Feb INVITATION- Budget-Union Budget, GST, GST UPDATES, Invitations, IT, Programs / By Aravind Paul / No Comments / 278 Viewers

You are Heartily Invited for our meeting on Analysis of Budget 2020,Income tax compliance & new GST Returns. “Assuring you of our best service Ablways” Team Paul & Aravind

Continue Reading 02

02

Feb A to Z of GST- GST / By Aravind Paul / No Comments / 244 Viewers

3rd Revised edition Re-Printed on : 11-05-2017

Continue Reading 18

18

Dec 38th GST COUNCIL UPDATE- GST, GST UPDATES / By Aravind Paul / No Comments / 293 Viewers

As per the Press Release following the 38th GST Council Meeting, e-Way Bill will be blocked even if GSTR 1 is NOT filed for 2 consecutive tax periods. Further, due date for GSTR 9 / GSTR 9C for the FY 2017-18 extended to 31st January, 2020.

Continue Reading 12

12

Jun Transition plan to the new GST Return- GST / By Aravind Paul / No Comments / 291 Viewers

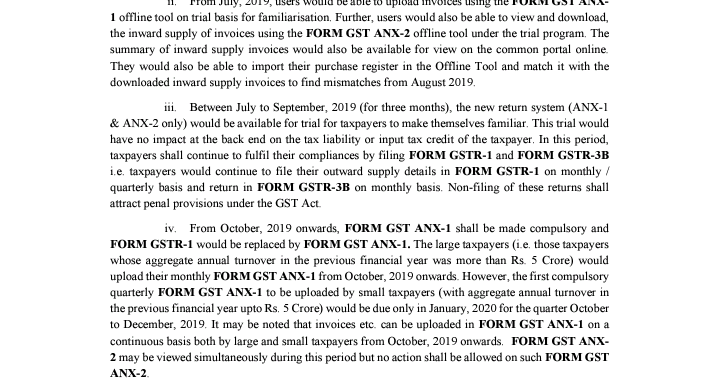

*CBIC Issues Transition plan to the new GST Return to be made coumpulsory from GST Returns for October 2019*

Continue Reading 29

29

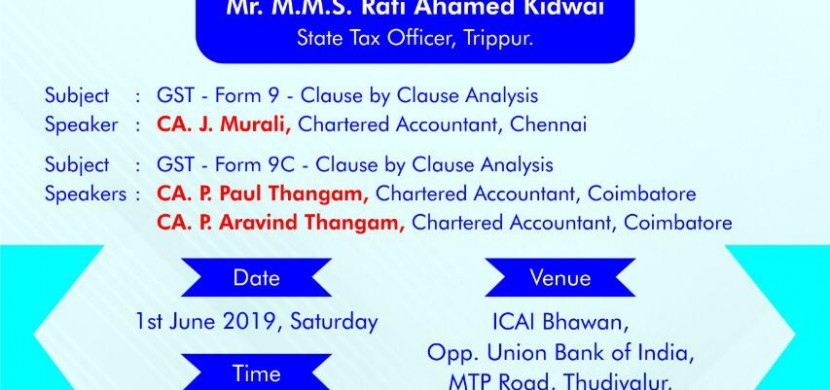

May One day seminar on GST Annual Return and GST Audit – 1st June, 2019- GST, Invitations, Programs / By Aravind Paul / No Comments / 499 Viewers

Team Paul & Aravind is pleased to share with you that our Partners CA. P. Paul Thangam and CA. P. Aravind Thangam are addressing on the topic of “GSTR 9C – Clause by Clause Analysis” on 1st June, 2019 (Saturday) at the exclusive one day seminar organized for the Trade and Industry by The Institute

Continue Reading 27

27

May Kerala Flood Cess notified w.e.f.01st June 2019- GST / By Aravind Paul / No Comments / 674 Viewers

The 32nd GST Council Meeting held on 10th January 2019 had approved a Cess on INTRA-STATE Supply of Goods and Services within the State of Kerala at a rate not exceeding 1% for a period not exceeding 2 years. Pursuant to the approval at GST Council, Kerala Finance Bill, 2019 has provided for this Cess

Continue Reading 09

09

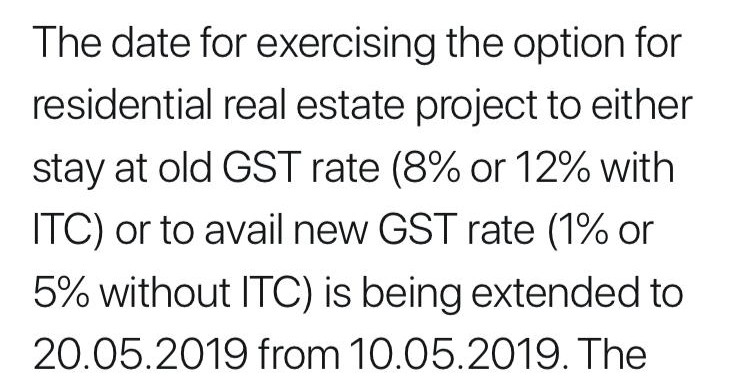

May Exercising option of reduced rates by Construction Companies – Time Limit extended to 20.05.2019- GST / By Aravind Paul / No Comments / 381 Viewers

Notn . No. 03/2019 dt. 29-03-2019 provided for lower rates of GST at 1% or 5% without ITC. The lower rates were only an option for the existing projects and the real estate companies had to choose from either of the following options – a.) Pay GST at Normal Old Rates of 8% or 12%

Continue Reading