-

23

23

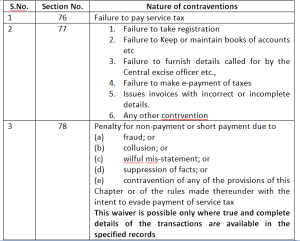

Mar PENALTIES UNDER THE SERVICE TAX PROVISIONS- (Category: Service Tax)

There is a lot of difference the way in which penal provisions are invoked under the Income Tax Act and other indirect tax legislations. In the income tax the penalty is levied in a selective manner. But under the indirect tax provisions the penalty is levied even at the first stage. So one must know fully the legal provisions regarding the various penalties that can be imposed under the service tax provisions.

PENALTY FOR FAILURE TO TAKE REGISTRATION: [Section 77 (1) (a)]

Section 69 of Finance Act, 1994 says that every person liable to pay the service tax shall make an application for registration to the Superintendent of Central excise. But the time limit for making application is given in rule 4 of Service tax rules, 1994. According to this rule registration within a period of thirty days from the date on which the service tax is levied.

In case a person starts the business after the levy, he should apply for registration within 30 days of commencement of business. Though service tax liability arises only after crossing a turnover of Rs.10 Lakhs, According to SERVICE TAX (REGISTRATION OF SPECIAL CATEGORY OF PERSONS) RULES, 2005, Any provider of taxable service whose aggregate value of taxable service in a financial year exceeds nine lakh rupees shall make an application to the jurisdictional Superintendent of Central Excise in such form as may be specified, by notification, by the Board, for registration within a period of thirty days of exceedingthe aggregate value of taxable service of nine lakh rupees

If the registration is not taken within this period then penalty upto Rs.10,000/- can be levied. Before finance act this penalty was Rs.10,000/- or Rs.200/- per day whichever is higher.

PENALTY FOR FAILURE TO KEEP, MAINTAIN OR RETAIN BOOKS OF ACCOUNTS AND OTHER RECORDS: [Section 77 (1) (b)]

The service tax provisions does not say about the books to be maintained. Rule 5 of Service tax says that The records including computerised data as maintained by an assessee in accordance with the various laws in force from time to time shall be acceptable. So the records maintained for income tax shall be acceptable under the service tax provisions. But every assessee at the time of filing his first return shall furnish to the superintendent of central excise, a list in duplicate regarding.

(i)all the records prepared or maintained by the assessee for accounting of transactions in regard to, –

(a) providing of any service,

(b) receipt or procurement of input services and payment for such input services;

(c) receipt, purchase, manufacture, storage, sale, or delivery, as the case may be, in regard of inputs and capital goods;

(d) other activities, such as manufacture and sale of goods, if any.

(ii) all other financial records maintained by him in the normal course of business.;

These records should be maintained for a period of FIVE years. Failure to maintain these records will attract a penalty of Rs.10,000/-PENALTY FOR FAILURE TO FURNISH INFORMATION OR PRODUCE DOCUMENTS OR APPEAR BEFORE THE CENTRAL EXCISE OFFICER. [Section 77 (1) (c)]

For the above mentioned offences, the penalty is Rs.10,000/- or Rs.200/- per day which ever is higher. The rate per day will start from the due date till the date of compliance.

PENALTY FOR NOT MAKING ELECTRONIC PAYMENT OF TAXES THROUGH INTERNET BANKING: [Section 77 (1) (d)]

According to proviso to sub-rule (2) of rule 6 of Service tax rules, 1994, where an assessee has paid a total service tax of rupees ten lakh or more including the amount paid by utilisation of CENVAT credit, in the preceding financial year, he shall deposit the service tax liable to be paid by him electronically, through internet banking. If payment is not made in such a manner then there will be a penalty of Rs.10,000/-

ISSUE OF INCOMPLETE INVOICE: [Section 77 (1) (e)]

According to rule 4A of Service tax rules, 1994. The invoice, bill or, as the case may be, challan shall be serially numbered and shall contain the following, namely :-

(i)the name, address and the registration number of such person;

(ii)the name and address of the person receiving taxable service;

[(iii)description and value of taxable service provided or agreed to be provided; and] (iv)the service tax payable thereon :If the details are incorrect and incomplete then penalty upto Rs. 10,000/- can be imposed.

PENALTY FOR FAILURE TO PAY SERVICE TAX:

Section 76 of the Finance Act, 1994 deals with the case of penalty for failure to pay or delay in the payment of service tax. The penalty contemplated is Rs.100/- per day of default or interest of 1% per month computed on daily basis, whichever is higher. The period for the computation of the penalty is starting from first day after the due date till the date of actual payment of service tax. The only concession is that the penalty under this section cannot exceed 50% of the service tax payable.

PENALTY FOR SUPPRESSION OF VALUE OF TAXABLE SERVICES: (Section 78)

This is the important penal provision that is often invoked by the department. It is equal to concealment penalty under the income tax provisions. This penal provisions are attracted when there is short payment or non-payment of service tax due to

(a) fraud; or

(b) collusion; or

(c) wilfulmis-statement; or

(d) suppression of facts; or

(e) contravention of any of the provisions of this Chapter or of the rules made thereunder with the intent to evade payment of service tax,The penalty under this section is equal to the amount of service tax so not levied or paid or short-levied or short-paid or erroneously refunded.

When the true and complete details of the transactions are available in the specified records, penalty shall be reduced to fifty per cent. of the service tax so not levied or paid or short-levied or short-paid or erroneously refunded.

The above mentioned penalty of 50% can be further reduced to 25% if the service tax and interest determined is paid with in a period of 30 days. The reduced penalty of 25% too should be paid with in a period of 30 days.

In case of small service providers having a whose value of taxable services does not exceed sixty lakh rupees during any of the years covered by the notice or during the last preceding financial year, the period of 30 days shall be extended to 90 days.

One saving grace is that there is not simultaneous penalty under the provisions of section 76 and 78 of the finance act, 1994.

PERSONAL PENALTY ON DIRECTORS OF THE COMPANY: [Section 78A]

This is newly introduced section which levies personal penalty on the following categories of persons in case of companies.

1.Director

2.Manager

3.Secretary

4.Other officer of the company.The above categories of persons should be at the time of such contravention was in charge of, and was responsible to, the company for the conduct of business of such company and was knowingly concerned with such contravention.

The following are the contraventions contemplated for the personal penalty. They are

(a) evasion of service tax; or

(b) issuance of invoice, bill or, as the case may be, a challan without provision of taxable service in violation of the rules made under the provisions of this Chapter; or

(c) availment and utilisation of credit of taxes or duty without actual receipt of taxable service or excisable goods either fully or partially in violation of the rules made under the provisions of this Chapter; or

(d) failure to pay any amount collected as service tax to the credit of the Central Government beyond a period of six months from the date on which such payment becomes due,

Penalty amount may extend upto Rs.1,00,000/-NO PENALTY IN CASE OF REASONABLE CAUSE: [Section 80]

This sections is equivalent to section 273B of Income tax act, 1961.

If the assessee proves that there is reasonable cause for the failure or contraventions contemplated under the following penalty levying sections, no penalty can be levied.

About thr author : admin